All Categories

Featured

Table of Contents

That generally makes them a more economical option for life insurance protection. Some term plans might not maintain the costs and survivor benefit the very same over time. What is direct term life insurance. You do not intend to erroneously assume you're acquiring level term coverage and after that have your death advantage change later. Many people obtain life insurance policy coverage to aid economically safeguard their loved ones in case of their unforeseen death.

Or you may have the alternative to transform your existing term insurance coverage right into a long-term plan that lasts the rest of your life. Various life insurance plans have prospective benefits and disadvantages, so it's vital to recognize each prior to you decide to purchase a plan.

As long as you pay the costs, your beneficiaries will certainly obtain the fatality advantage if you pass away while covered. That claimed, it's essential to note that a lot of plans are contestable for 2 years which means coverage could be rescinded on fatality, needs to a misrepresentation be located in the application. Policies that are not contestable commonly have actually a rated survivor benefit.

How Does Level Term Life Insurance Policy Work for Families?

Costs are generally lower than entire life policies. With a level term policy, you can pick your insurance coverage quantity and the plan size. You're not secured into an agreement for the remainder of your life. Throughout your plan, you never ever have to bother with the costs or death benefit amounts changing.

And you can't cash out your policy throughout its term, so you will not obtain any type of financial gain from your past coverage. As with various other types of life insurance policy, the price of a level term plan depends on your age, coverage requirements, work, way of living and wellness. Commonly, you'll find a lot more economical coverage if you're more youthful, healthier and less dangerous to insure.

Because degree term costs stay the exact same throughout of protection, you'll recognize exactly just how much you'll pay each time. That can be a large help when budgeting your expenditures. Degree term insurance coverage likewise has some flexibility, allowing you to personalize your plan with extra attributes. These frequently can be found in the kind of motorcyclists.

The Benefits of Choosing Decreasing Term Life Insurance

You might have to fulfill details conditions and qualifications for your insurance provider to establish this motorcyclist. Furthermore, there may be a waiting duration of up to six months prior to working. There additionally could be an age or time limitation on the protection. You can include a child motorcyclist to your life insurance coverage policy so it additionally covers your youngsters.

The death benefit is commonly smaller, and coverage normally lasts until your child turns 18 or 25. This rider may be a much more cost-effective means to aid ensure your kids are covered as cyclists can commonly cover multiple dependents simultaneously. As soon as your child ages out of this protection, it may be possible to transform the rider right into a new plan.

When contrasting term versus permanent life insurance policy, it is necessary to keep in mind there are a few various types. The most usual type of irreversible life insurance is entire life insurance policy, yet it has some vital distinctions compared to degree term coverage. Short Term Life Insurance. Here's a standard overview of what to think about when contrasting term vs.

Entire life insurance lasts permanently, while term coverage lasts for a specific period. The costs for term life insurance coverage are normally less than entire life insurance coverage. With both, the premiums continue to be the exact same for the duration of the policy. Whole life insurance policy has a cash value part, where a portion of the premium may expand tax-deferred for future needs.

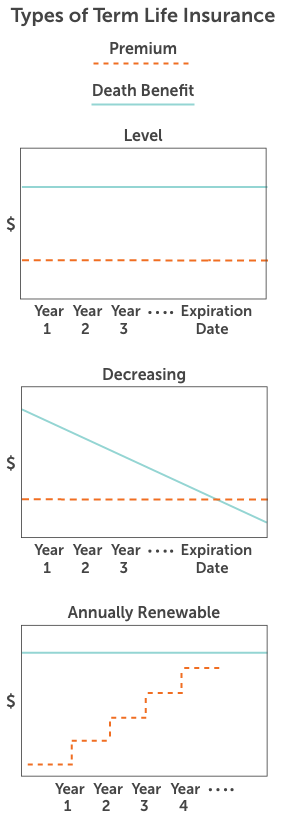

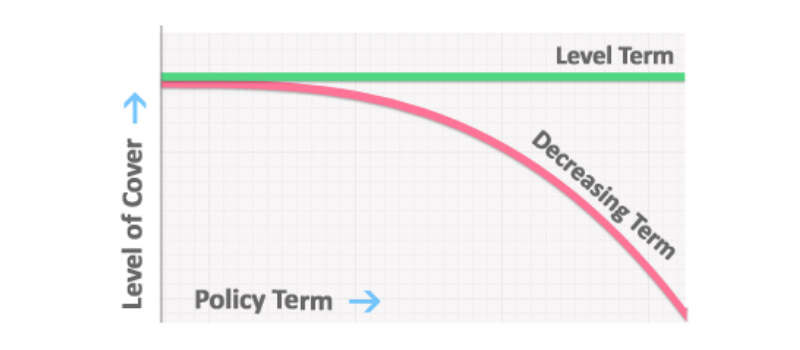

Among the major features of level term protection is that your premiums and your fatality benefit do not alter. With decreasing term life insurance policy, your costs continue to be the very same; nonetheless, the survivor benefit quantity obtains smaller sized over time. You might have coverage that begins with a fatality benefit of $10,000, which can cover a home mortgage, and after that each year, the fatality advantage will lower by a set amount or percent.

Due to this, it's often a more cost effective kind of level term protection., however it might not be adequate life insurance policy for your demands.

How Does 20-year Level Term Life Insurance Protect You?

After making a decision on a policy, finish the application. If you're approved, authorize the paperwork and pay your very first premium.

You might desire to update your beneficiary information if you've had any kind of considerable life modifications, such as a marriage, birth or separation. Life insurance policy can occasionally really feel challenging.

No, level term life insurance policy does not have cash worth. Some life insurance coverage policies have a financial investment function that allows you to construct cash value gradually. A portion of your costs repayments is alloted and can gain interest in time, which expands tax-deferred during the life of your insurance coverage.

These plans are typically considerably extra pricey than term protection. If you get to the end of your plan and are still to life, the protection ends. You have some choices if you still want some life insurance coverage. You can: If you're 65 and your coverage has gone out, for instance, you may wish to purchase a new 10-year degree term life insurance policy.

What is Short Term Life Insurance? Pros, Cons, and Features

You may have the ability to transform your term coverage into a whole life policy that will last for the remainder of your life. Several kinds of degree term plans are convertible. That suggests, at the end of your insurance coverage, you can convert some or all of your policy to whole life insurance coverage.

A degree costs term life insurance policy strategy allows you adhere to your spending plan while you aid protect your family members. Unlike some stepped price strategies that raises annually with your age, this kind of term plan uses prices that remain the same for the period you select, even as you get older or your wellness adjustments.

Find out more about the Life insurance policy alternatives available to you as an AICPA member (Voluntary term life insurance). ___ Aon Insurance Policy Services is the brand name for the brokerage and program administration operations of Fondness Insurance policy Providers, Inc. (TX 13695) (AR 100106022); in CA & MN, AIS Affinity Insurance Policy Agency, Inc. (CA 0795465); in Okay, AIS Affinity Insurance Services Inc.; in CA, Aon Affinity Insurance Policy Providers, Inc .

Latest Posts

Final Expense Insurance

Term Life Insurance Instant Quotes

Life Insurance Instant Quotes