All Categories

Featured

Table of Contents

Plans can likewise last till specified ages, which in the majority of cases are 65. Past this surface-level information, having a greater understanding of what these strategies involve will assist guarantee you buy a plan that satisfies your requirements.

Be mindful that the term you select will influence the premiums you spend for the plan. A 10-year level term life insurance coverage plan will set you back less than a 30-year plan since there's much less opportunity of an event while the plan is active. Lower threat for the insurance provider relates to reduce premiums for the insurance holder.

Your family's age ought to additionally affect your policy term choice. If you have young kids, a longer term makes sense because it secures them for a longer time. If your kids are near the adult years and will be monetarily independent in the near future, a shorter term could be a far better fit for you than a lengthy one.

When comparing whole life insurance policy vs. term life insurance, it deserves keeping in mind that the last usually costs much less than the previous. The outcome is a lot more insurance coverage with lower costs, offering the finest of both worlds if you require a significant amount of coverage but can't pay for a more costly plan.

What is 30-year Level Term Life Insurance? A Simple Explanation?

A level survivor benefit for a term policy usually pays out as a lump amount. When that takes place, your successors will certainly receive the whole quantity in a single repayment, which amount is not thought about revenue by the IRS. Those life insurance proceeds aren't taxed. However, some degree term life insurance coverage companies permit fixed-period payments.

Passion payments received from life insurance coverage policies are thought about revenue and undergo taxation. When your degree term life policy expires, a few different things can take place. Some insurance coverage ends right away without alternative for renewal. In various other situations, you can pay to prolong the strategy beyond its original date or transform it into a long-term policy.

The drawback is that your renewable level term life insurance policy will come with higher premiums after its initial expiration. Ads by Money.

Life insurance policy business have a formula for calculating threat making use of death and interest (Decreasing term life insurance). Insurance companies have countless customers taking out term life policies at the same time and make use of the costs from its energetic plans to pay surviving recipients of various other policies. These business use mortality to approximate just how lots of individuals within a particular team will submit death cases annually, and that information is used to identify ordinary life span for possible insurance holders

Furthermore, insurer can invest the cash they get from costs and increase their revenue. Given that a level term plan does not have cash value, as an insurance policy holder, you can not invest these funds and they don't supply retirement earnings for you as they can with whole life insurance coverage policies. The insurance policy business can invest the money and gain returns.

The list below section information the benefits and drawbacks of degree term life insurance coverage. Predictable premiums and life insurance policy protection Simplified policy structure Potential for conversion to irreversible life insurance policy Restricted coverage period No cash money worth accumulation Life insurance policy premiums can raise after the term You'll locate clear advantages when comparing degree term life insurance policy to other insurance kinds.

Is Term Life Insurance the Right Choice for You?

From the minute you take out a plan, your premiums will certainly never transform, assisting you prepare monetarily. Your coverage won't differ either, making these policies efficient for estate preparation.

If you go this path, your costs will certainly increase but it's always good to have some versatility if you wish to maintain an energetic life insurance policy. Sustainable level term life insurance policy is one more choice worth thinking about. These plans permit you to keep your existing strategy after expiration, offering adaptability in the future.

What Is Level Term Life Insurance Meaning Coverage and How Does It Work?

Unlike a entire life insurance policy policy, degree term coverage doesn't last forever. You'll select an insurance coverage term with the best degree term life insurance policy prices, however you'll no longer have insurance coverage once the plan runs out. This drawback could leave you rushing to discover a new life insurance policy plan in your later years, or paying a costs to expand your present one.

Several entire, universal and variable life insurance policy policies have a money worth part. With one of those plans, the insurance provider deposits a portion of your regular monthly costs settlements right into a money worth account. This account earns rate of interest or is invested, helping it expand and offer a more substantial payout for your beneficiaries.

With a level term life insurance policy, this is not the situation as there is no cash value part. Because of this, your policy won't expand, and your death benefit will never ever raise, thereby restricting the payment your recipients will certainly receive. If you desire a plan that gives a survivor benefit and constructs cash worth, consider entire, universal or variable plans.

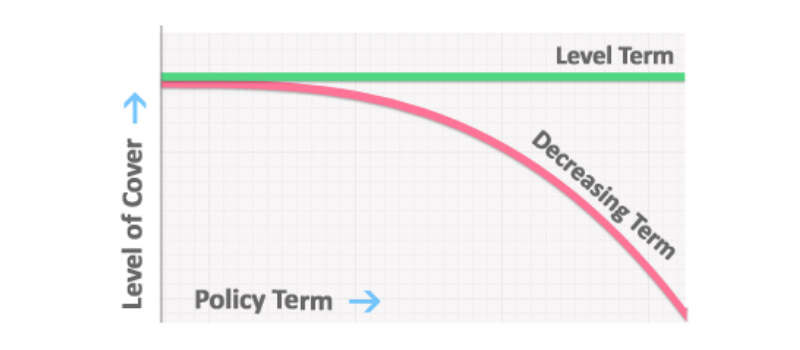

The 2nd your plan runs out, you'll no much longer have life insurance policy protection. Degree term and reducing life insurance deal comparable policies, with the primary difference being the fatality benefit.

It's a kind of cover you have for a specific amount of time, referred to as term life insurance policy. If you were to pass away while you're covered for (the term), your liked ones receive a fixed payout agreed when you obtain the policy. You simply pick the term and the cover quantity which you could base, for example, on the price of raising children up until they leave home and you might utilize the payment in the direction of: Aiding to settle your home loan, financial obligations, bank card or car loans Assisting to spend for your funeral expenses Aiding to pay university fees or wedding celebration costs for your kids Aiding to pay living prices, changing your revenue.

What is Level Premium Term Life Insurance Policies and How Does It Work?

The plan has no money worth so if your repayments quit, so does your cover. If you take out a level term life insurance coverage plan you could: Pick a taken care of quantity of 250,000 over a 25-year term.

Latest Posts

Final Expense Insurance

Term Life Insurance Instant Quotes

Life Insurance Instant Quotes